Evolution Online – EON

MTPL - solution for car insurance sale

About client

UNIQA Serbia is a member of one of the leading European insurance concerns – Austrian UNIQUA Group, doing business in 18 European markets with 9.6 mn clients and a 200-year-long tradition. In Serbia, it has operated for more than 20 years. Ever since its foundation, UNIQUA has made as many as 3 mn policies with more than 500,000 people of different generations, levels and types of education and life plans, large and medium-sized companies, the experienced and the beginners.

Context

Solution

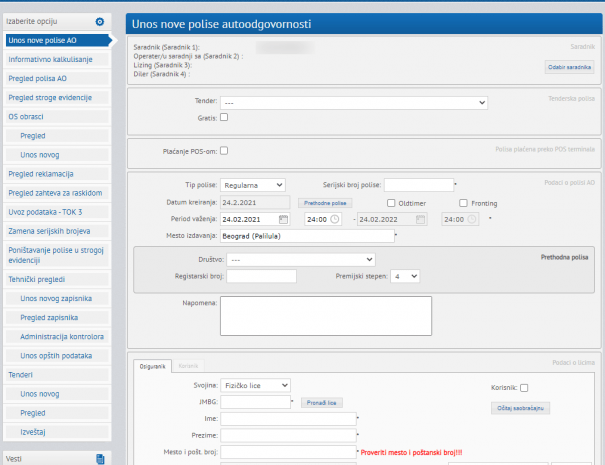

After a due diligence of the existing system, we have designed a solution which was supposed to satisfy the basic requirements for the sale of car insurance policies, and to expand functionalities and include the motor vehicle inspection segment. Namely, the analysis confirmed that numerous system users have the motor vehicle inspection as its core competency, and need to have a register of inspected vehicles, technical details regarding the inspection, client base management, payments and other activities necessary to operate normally. Ahead of the new law, the sale of insurance policies to these users was an additional activity, mostly done manually, by filling in paper policies. Now this activity had to be digitalized, namely the policy was supposed to issued electronically, directly from the system linked to the insurance company and servers of the Association of Insurers of Serbia, in real time. In such circumstances, motor vehicle inspection employees had to add numerous information two times, in two independent systems, which required more time, and additional cost.

After we have taken a deep look into the entire process, a system which contained two modules was designed – one to issue policies and another to register necessary motor vehicle inspection-related data, which provided a fast and efficient system which required insertion of data in a single place.

The very insertion of data about the vehicle and the policy holder is simplified with the development of plug-ins for all modern search engines, which enables the use of traffic license readers and ID readers. With this, the number of mistakes upon data insertion is reduced to minimum and the speed of operations accelerated multiple times. The user was obliged to manually insert only the policy number and validity period, whereas other data have been added d with one click.

Client:

Uniqa Insurance

Industry:

Insurance

Size:

Large company

Period:

2012 –

Status:

System is in use and constantly updated.

Category:

Special-purpose software development, business analysis, project management

Technology:

HTML CSS Javascript Jquery .NET ASP.Net C# C++ MSSQL MS Reporting Services

Integrations:

Association of Insurers of Serbia MS IE/ Chrome/Firefox plugin Traffic license and ID readers Uniqa core system

Specific features:

Implementation of plugins in different browsers mplementation in several countries module for printing of different forms

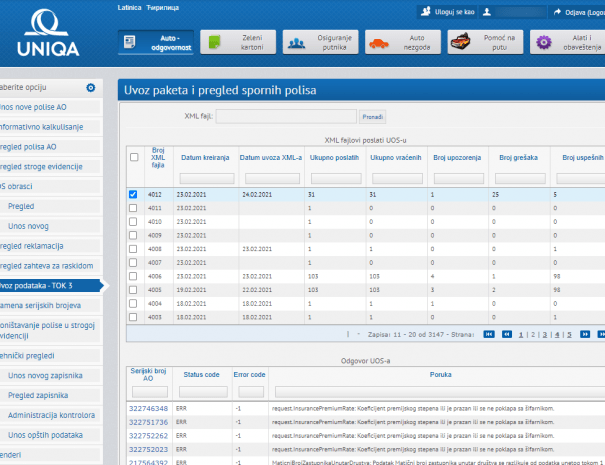

The new system of car insurance policies has been integrated with the central insurance information system of the Association of Insurers of Serbia, which enables safe and efficient exchange of all necessary information in real time. The app is offered in several languages, which additionally facilitates the use at sales locations where Serbian was not the only language in use.

In addition to basic sales functionalities (insertion of basic data on the insurer, policy holder, premium packages, vehicle data, invoicing etc. ) we have enabled an electronic register of issued policies, the so-called strict register where paper policies, following preparation and printing were automatically returned, thus enabling all participants to have an insight into a register of strict-register policies and to plan next steps depending on that, for example, ordering new package of policy forms, all in real time.

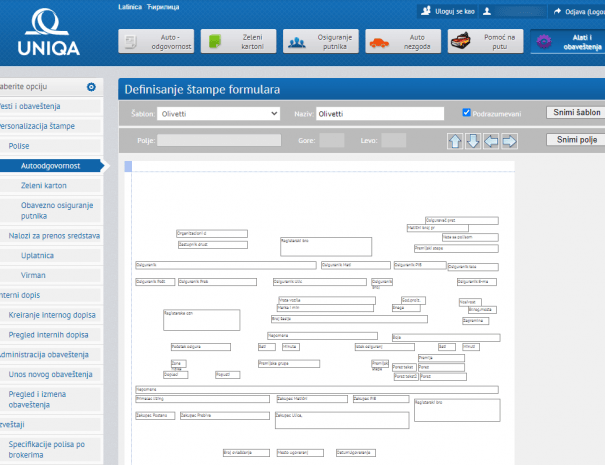

With an aim to facilitate work to users as much as possible, a special module to set the visual appearance of printing documents, namely graphic interface enabling the user to set the margins on its own, namely position the printing of certain information has been designed.

In addition to the creation of car insurance policies, the new app creates other types of policies too, which directly depend on the AO policies – the green card policy, mandatory travel insurance and passenger insurance and, after very positive reactions from users, within the group the decision was made to develop the Road Support product as part of our MTPL app.

Basic functionalities of Motor Vehicle Inspection module:

Inserting and administration of data on completed motor vehicle inspection (TP) conducted by supervisors (people in charge of inspection);

- Printing of the record and/or registration paper (depending on the type of motor vehicle inspection: regular annual, regular six-month registration, extraordinary and change of technical data;

- Fast and advanced search f executed motor vehicle inspections, according to all key criteria;

- Administration (insert/delete /change) of supervisors in charge of the inspection;

- Having in mind strict criteria and standards defined by the Republic of Serbia (National Bank of Serbia and Association of Insurers of Serbia) as well as standards of UNIQA Group, the new app underwent numerous tests and received highest scores and entered the production very quickly.

The success of the realized system has been confirmed with the implementation in Montenegro, with new functionalities – issuance of border insurance policy and vessel insurance policy.

The entire system was developed with the implementation of state-of-the-art Microsoft technologies, with a special accent on system safety, having in mind that we are talking about a web app available to all external associates via open Internet, without private connections with individual system users.

Benefits

In addition to obvious cost savings in system maintenance reflected in the need to install desktop apps (sometimes even additional settings at the client’s PC are necessary), which is the not case with the web app (it is enough to forward Internet link and user account to the user), the very system design significantly facilitated work to users). A very intuitive graphic solution has enabled users to enter data fast and, subsequently, processing of higher number of demands in the same time interval.

In a short period, the app turned out to be a very good tool in the market game since satisfied system users in motor vehicle inspections, when selling the policy, in case the client did not want something different, always wanted to work in the UNIQA system they felt most comfortable to work with, and also increased efficiency.

TIN: 102789279

Bank Account:

170-30005036000-02

Bank Account:

170-30005036000-02

TIN: 102789279