Evolution Online – EON

wienHousehold – core app for the sale of household insurance policies

About Client

Context

Wiener Städtische insurance was obliged to realize new app for the sale of insurance policies for households within exceptionally short deadlines, first of all for the banking sector and the sale of household insurance with mortgage loans.

In addition, the situation was made even more complex owing to the fact that the banking sector’s practices differed much than practices implemented in other sales sectors and that it was necessary to provide special architecture due to joint processes by several internal services, and to prepare a field for potential integrations with other systems outside the company.

An urgent solution was necessary and urgent solutions require people who know the business process problems in detail, property insurance in this case.

Solution

Since the moment we were hired for this job, we embarked on intensive and detailed analyses of specific features of the process in question, as well as analysis of future requirements. We have prepared a business analysis, and specific features both of process, and proposals of solutions in detail.

The primary target of the proposed solution was, of course, realization of the new app to issue property insurance policies and property interests with vinculation, for the necessities of banks as representatives in insurance and the internal network, namely other sales channels.

However, the project also had an important secondary aim, namely the introduction of the microservice architecture into the new service, as well as part of existing services, which would enable the use of realized solutions both by other services within the company, and by apps of external partners.

Our solution has envisaged the creation of multiple services, which would cover the basic needs of the app in question, including the following:

Client:

Wiener Stadtische Insurance

Industry:

Insurance

Size:

Large company

Period:

2019 –

Status:

System is in use and constantly updated.

Category:

Special-purpose software development, business analysis, project management

Technology:

HTML CSS Javascript Jquery .NET ASP.Net C# MSSQL MS Reporting Services

Integrations:

WSO core system different partner systems

Specific features:

Development with exceptionally short deadlines Microservice architecture

- service to define and obtain data regarding business regulations applied to the user in question (combination of insurance items – package – risk, possible duration of insurance you can opt for, payment dynamics etc.);

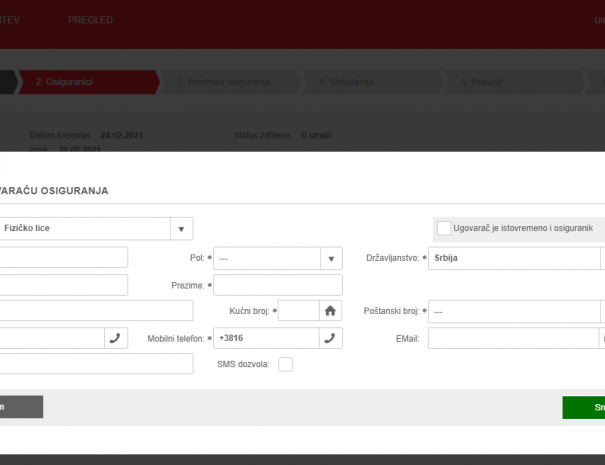

- service for data management about client-partners and ownerships over partners, depending on the user who is requesting these data, as well as sales channels s/he belongs to;

- service for calculation and preparation of proposal and policy, with implemented business regulations and controls in comparison with the user who initiates the request;

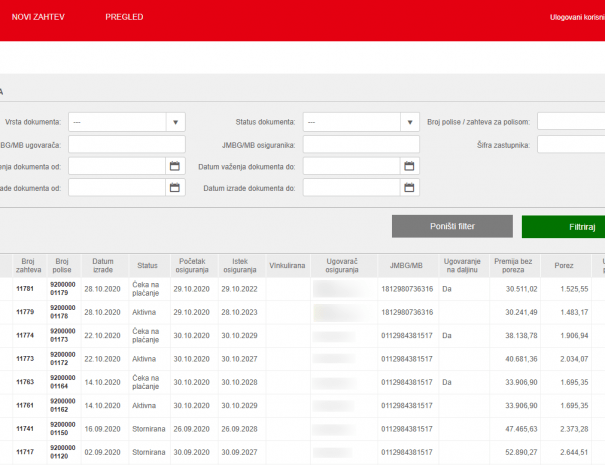

- request and policy data search service, adoption of role and hierarchies regulations in sales channels;

- services as interfaces towards other apps and important bases, such as central WSO base;

- services for printing of all necessary documents in accordance with business rules.

Benefits

Since the very first day in operational use, the system turned out to be very flexible and simple to handle by end users. The time necessary to create the policy has been reduced whereas even more important benefit was the option to apply business regulations in different services and apps.

Owing to the installed microservice architecture of the system, very quickly, other apps and systems started using services regarding proposals and property policies (calculation, policy making, printing document, search with adopted ownership business regulations etc.). Soon a module for online household policy sales was made, a mobile app envisaged for sales agents and integrations with other sales rep who added the sale of household policies of this insurance policies to their online sales locations – each one of them directly relying on joint services with central management.

TIN: 102789279

Bank Account:

170-30005036000-02

Bank Account:

170-30005036000-02

TIN: 102789279